Is Verticle Farming the Future of Agriculture?

Exciting topics, weekly ag action & commodity market review

INTRODUCTION:

Welcome everyone to this week’s newsletter. The ag topic of the week is verticle farming, something that has been making a lot of noise in the industry lately.

If you have any questions do not hesitate to reach out.

Read time: 13 minutes

CONTENTS:

Ag Topic of the Week:

Is Verticle Farming the Future of Agriculture?

Weekly Ag Action:

Canada's Supreme Court Rules in Favour of National Carbon Tax

Richardson International to Expand Yorkton’s Crush Plant

Ag Advantage Ltd and Pinewood Crop Services Ltd Form Partnership

U.S. Winter Wheat Forecast Improving

Mosaic Announces Partnerships with AgBiome

Container Ship Could Block Suez Canal for Weeks

Canada Now Top U.S. Ethanol Customer

Weekly Commodity Market Action:

Crude oil prices see increases

Soybeans not far from a 6-1/2-year high

Wheat touches the lowest level Friday since December

Lumber up with expectations of economic rebound

Corn prices higher at close Friday

Feeder Cattle closed Friday’s session with gains

Lean Hog futures closed with gains

Live Cattle futures closed Friday’s session with gains also

Is Verticle Farming the Future of Agriculture?

Planet Earth’s human population has been rapidly increasing since year 0. After The Black Death pandemic in Europe in the 14th century that killed roughly 200 million people, the populations started exploding from 600 million people in the 1700s to, 7.7 billion in 2021, with 9.7 billion to be expected by 2050. It certainly doesn’t take a rocket scientist to spot the immediate problem, how are we going to feed nearly 10 billion heads, and more importantly what are we doing to prepare.

A particular innovative farming method that is showing promise is vertical farming. A method that allows fruits, vegetables, or cannabis to be produced in a vertical fashion where rows of produce are stacked on trays inside of a building using artificial lights as a replacement for the sun allowing them to enhance the process of photosynthesis. With the limitations of our natural resources and productive farmland, verticle farming looks to be a bright alternative. However, this innovation has some of its own drawbacks and disadvantages.

The topic has been a highlight of discussion in agriculture recently as a number of startups have been receiving tens of millions of dollars in investment. Vertical farming offers a low-cost alternative for cannabis, as traditional methods require greenhouses that cost millions in land purchases. A lot of the tech involved in these operations have been available for quite some time but it has become increasingly more affordable making it a more viable business proposition. The plants are typically grown hydroponically where plant roots are typically submerged in water, or aeroponically where roots hang in the open air with no mechanical resistance from soil enabling the roots to grow with abandon to support much larger foliage, bloom, & fruit growth in the canopy. Some other key technologies include:

Artificial control of light

Environmental control

Self-acting robots to pick produce

These are just a few basic key technologies that are already commercially used and when combined with emerging technologies that will come into play in the future, it will basically eliminate the need for human labour.

Companies focusing on vertical farming have experienced a hike in momentum during the COVID-19 pandemic as a variety of issues emerged in our food supply chain. Poor demand forecasting and supply delays amongst the list of problems. In 2019 alone it was estimated that verticle farming generated $212.4 million in revenue, while Allied Market Research forecasted the crop market to reach $1.38 billion in annual revenue by 2027, a growth rate of 26.2%. Frontrunners in the industry currently include:

<List derived from Allied Market Research>

PlantLab

Spread Co.

Green Spirits Farm

AeroFarms

Bowery Farming

CropOne

Plenty

InFarm

Gotham Greens

AgriCool

Despite the overall hype around verticle farming, there are still some drawbacks and risks that hold some back from believing in its full potential. There is the concern of energy and environmental impact, destabilization of communities, startup costs, and the risk of artificial environment failure.

In addition to artificial lighting that uses significant energy, a verticle farm has complex machinery and automated systems that are necessary for it to operate, this requires more energy input than a field farming operation.

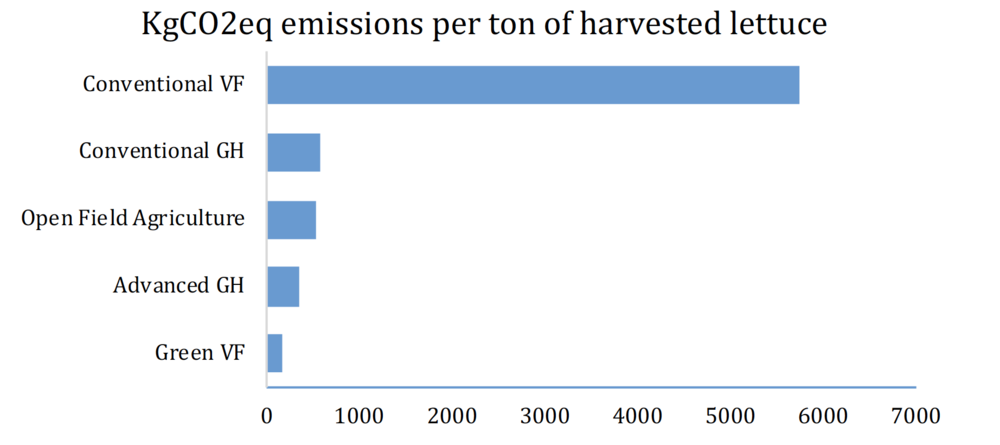

Before criticizing open-air industrial farming for the damage it does to our environment, use this graph above to compare it to our current alternatives. The kilograms of CO2 emitted per ton of lettuce harvested in a conventional vertical farm is far greater than the rest. However, it can be practiced with significantly lower emissions if it is powered by renewable energies.

The potential that these new methods of farming could be the future of agriculture create a problem in communities that rely on traditional agriculture. Verticle agriculture can make traditional farming work outdated and families that have relied on this work for many generations who live below the poverty line will suffer.

Additionally, a big risk in a verticle farm is the dependence on an artificial environment. Solely relying on technology is a major disadvantage as any energy shortages could lead to major production losses. With the high overhead costs involved in managing a verticle farming operation and the complexity of its systems, this could be detrimental in the unfortunate event of system failure.

Verticle agriculture is without a doubt an exciting innovation to the traditional methods of crop production. It has created a solution to land usage and allowed produce to be grown locally within cities but it must rely on technology and significant usage of energy. If green energy sources can be used and mastered in these types of operations, this could very well be a large part of agriculture’s future.

Canada's Supreme Court Rules in Favour of National Carbon Tax

The national carbon tax in Canada is here to stay as the Supreme Court rules in favor. Ottawa saw push back from just three provincial governments but ultimately the carbon tax was favoured six to three.

What is Trudeau’s carbon tax?

It sets minimum pricing standards for provinces to meet. Provinces are allowed to implement their own plans. However, if provinces fall short of the national standard or do not implement a system, Ottawa will apply its own carbon tax.

Its current price sits at C$30 (£17.35) per tonne of carbon dioxide released and will rise sharply to C$170 (£98.38) per tonne by 2030.

This is a big political win for Trudeau.

Unfortunately, this will come as a burden on hard-working people and the poorest will have to pay more mentions Doug Ford (Ontario Premier) and Jason Kenny (Alberta Premier)

Canada Warming Twice as Fast as the Rest of the World

Is Trudeau Doing Enough on Climate Change?

Richardson International to expand Yorkton’s Crush Plant

An investment that needed to happen as global demand for canola oil canola meal is rising. Richardson International has announced its big plans for one of its crush plants located in Yorkton, Saskatchewan. Their processing capacity will double in size servicing 2.2 million metric tonnes annually when completed.

The facility will include a high-speed shipping system with three 9,500ft loop tracks.

It will serve both major railways and will be dedicated to moving canola crush products at some of the most efficient levels seen in North America.

The site will also boast three high-speed receiving lanes, providing producers and trucking partners a fast and effective means for seed delivery.

additionally improving operational efficiencies, modernization, and automation.

This seems to come as a natural step for Canada’s largest agribusiness after a significant investment in 2016 to upgrade their canola plant located in Lethbridge, AB dialing its processing capacity up 55%. Yorkton’s plant is scheduled to begin construction immediately and will not disrupt current operations.

This will generate a range of opportunities for work, Richardsons will be adding full-time positions to the plant.

Darrell Sobkow’s comments: (Senior VP, Processing, Food, and Ingredients)

“The global outlook for Canadian canola oil is promising, and this latest investment emphasizes our ongoing commitment to best-in-class facilities.”

Richardson Invests $120 Million to Upgrade Lethbridge Canola Plant

Ag Advantage Ltd and Pinewood Crop Services Ltd Form Partnership

Ag Advantage is an independent ag retail business that originated in Meadows, Manitoba in the 1970s and has grown into 3 three locations in Oakbank, MB & a partnership with Foster Ag Services. Ag Advantage prides itself on service to the customer through its knowledgeable staff, local data, and individualized customer recommendations.

Identifying a need for local accessibility to agronomists and their knowledge, and crop input products. The startup will service the farm customers of the Rainy River District by relying on business support and access to products from main suppliers and manufacturers via Ag Advantage Ltd.

Brielmann Agriculture Ltd and North End Farms Ltd have been working closely with Ag Advantage Ltd over the past several years to develop a crop production program for our specific environment. This partnership will ensure a stronger supply of current agricultural chemical, fertility, and seed advice locally. We plan to get to know our customers’ needs through strong agronomy and bring forward the best products from the main manufacturers to help the growers in the area earn the highest return on their crop input investment.

U.S. Winter Wheat Forecast Improving

Well-timed rains following a cold winter in the United States have helped winter wheat crops rebound nicely. almost the entire U.S. HRWW area has experienced precipitation. A good crop report is expected on April 5th noted Justin Gilpin, CEO at Kansas Wheat

The Black Sea region crop has been showing signs of improvement and SovEcon has recently forecasted their Russian wheat crop at 79.3 million tonnes, up 3.1 million tonnes in response to a mild winter and wet conditions. Additionally, Ukrainian wheat crop estimates have been forecasted at 27.8 million tonnes.

As yield prospects improve it has been recorded that a large number of cattle are being moved as wheat prices are looking bright influencing a larger number of harvested acres in Oklahoma and Texas.

Mike Schulte’s comments: (Executive Director of the Oklahoma Wheat Commission)

“Moisture conditions in my state are much better than they have been compared to the last 10 or 15 years.”

Mosaic Announces Partnerships with AgBiome

Mosiac is looking to continue building out its soil health portfolio and help its customers sustainably achieve their goals of increasing crop productivity and sustaining their lands into the future.

On March 23rd Mosiac announced their partnership with AgBiome as their next step in building out that soil health portfolio.

This collaboration to discover, develop and launch novel biological approaches to enhancing soil fertility will leverage AgBiome’s proprietary GENESIS™ platform that comprises the world's largest, most diverse, fully-sequenced collection of microbes coupled with innovative product discovery technology. Mosaic will lend its industry-leading expertise in soil health and product development, as well as its global distribution and sales network. Together the companies expect to find solutions that can be added to Mosaic’s soil health portfolio. Mosaic will have worldwide rights to the product, which has an anticipated launch date in 2025.

Mosiac has been a motivated company in the past year.

Earlier this month it was announced that they will be working with Sound Agriculture to developed and distribute a nutrient efficiency product.

Sus-Terra fertilizer production is beginning this month.

Last December Mosiac announced an agreement with BioConsortia to collaborate on new nitrogen-fixing microbial products.

Mosaic also recently completed investments in the Brazil venture capital firm, SP Ventures, and U.S.-based Lewis and Clark Ventures, and joined the Plug and Play Tech Center rounding out our global capabilities in technology scouting.

Soil Health Agreement with Sound Agriculture…

Sus-Terra Fertilizer…

BioConsortia to Collaborate on New Nitrogen-fixing Microbial Products…

Container Ship Could Block Suez Canal for Weeks

Eight tug boats and digging crews are working to dislodge a massive shipping vessel in the Suez Canal. The vessel was reportedly wedged between both shores blocking traffic in both directions as a result of a bad sand storm and heavy winds.

The Suez Canal is one of the world’s busiest shipping channels for oil and grain linking Asia and Europe. 206 large container ships, tankers carrying oil and gas, and bulk vessels hauling grain have backed up at either end of the canal, according to tracking data.

Ships have been rerouted around Africa adding an additional week to their journeys.

So what exactly does this mean now, well it’s not completely clear to me yet but I would start asking the following; global trade issues, will shipping rates skyrocket, what’s the probability of inflation?

Currently, the ship is holding up $400 million per hour in trade.

This is a great reminder of how disruptions in the supply chain can cause a domino effect if prolonged.

Canada Now Top U.S. Ethanol Customer

Canada has produced ethanol for a long time but hasn’t been able to match its consumption levels making it a large net importer. Consumption of ethanol hit 3.33 billion litres in 2019 but produced only 2 billion litres.

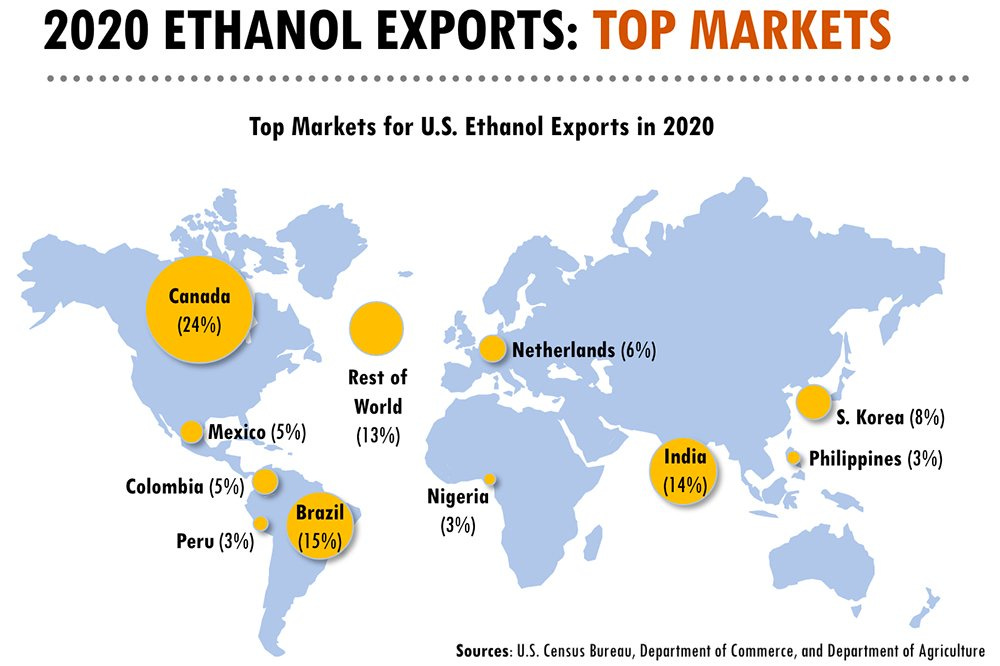

Canada imported 1.23 billion litres of biofuel in 2020. nearly identical volumes to the previous year but brazil’s plummeting sales falling 40% due to a mix of pandemic-related issues and the country’s introduction of a new tariff rate quota on imported products allowed Canada to scale the ranks taking the number one spot as the top U.S. ethanol customer.

This map gives a nice visual of who is importing ethanol via the United States.

Sales to China have dropped due to the trade war.

Exports to customers in Arabian Gulf have plummeted due to lower blending economics.

Mexico has doubled its ethanol purchases due to higher demand from the country’s industrial sector.

Shipments to India have benefited from the country’s six percent ethanol blend rate.

There are still a lot of details that need to be worked out with Canada’s CFS but boosting the federal ethanol mandate is on the table. Even if Canada moved to an E10 mandate, that would create the potential for an additional 2.46 billion litres in annual imports from the U.S.

Crude Oil

WTI oil prices increased 3.9% to $60.82 per barrel and Brent crude increased 4.1% to $64.48 per barrel over concerns that the Suez Canal blockage may last weeks and tighten supply.

Despite Friday’s rebound, oil prices declined during the week and booked their third consecutive weekly loss, with both benchmarks dropping nearly 3% over demand concerns stemming from rising coronavirus cases in multiple regions of the world.

Soybeans

Futures were trading around $14.2 per bushel in March, not far from a 6-1/2-year high of $14.6 per bushel hit earlier this month.

Investors now await the US Department of Agriculture’s March 31 planting intentions and quarterly stocks reports.

Wheat

Futures traded around $6.1 per bushel at the end of March, having touched on Friday its lowest level since December 28th, amid a stronger dollar and favorable weather across major producing regions including the US and Russia.

Production prospects in the two major exporting nations were boosted by forecasts indicating moisture this month

Russian agricultural consultancy IKAR said on Thursday it had increased its forecast for the country's wheat crop in 2021 to 79.8 million tonnes, up from 78 million tones previously projected. Elsewhere, traders looked ahead to US planting estimates next week.

Lumber

Lumber futures were trading around $950 per thousand board in March, buoyed by robust real estate markets and expectations of a swifter economic rebound fueled by massive government spending and vaccine rollouts.

With purchasers struggling to fulfill existing and new buying requirements, prices have room for further upside momentum

Corn

At the close on Friday corn prices were higher by 1 to 6 cents. May futures led the late-session rally but pulled the others nearby higher as well. New crop futures were up 1 to 1 1/4 cents. USDA quoted corn oil prices at 54.44 cents/lb on 3/26. They were citing a 43% increase from 38 c/lb in January. The rise in world veg oil prices has benefitted the yellow grain as well.

Feeder Cattle

Fat cattle futures closed Friday’s session with gains of 22 to 70 cents. June was the strongest on the day, widening its premium to April to $1.67. Cash trade this week has been mostly $1 higher at $115, with some $116 for NE. Dressed sales have mostly been $185 for the week. Feeder cattle futures closed with gains of 32 to 90 cents.

Lean Hogs

Futures closed with gains of $1.12 to $2.52. For April futures that is the 9th new life of contract high for this month, and is the highest front-month price since October of 2014. The CME Lean Hog Index was $93.85 on 3/23 after another 37 cent bump. USDA’s National Average Base Hog price for Friday was up $1.82 to $95.94.

Live Cattle

Futures closed Friday’s session with gains of 22 to 70 cents. June was the strongest on the day, widening its premium to April to $1.67. Cash trade this week has been mostly $1 higher at $115, with some $116 for NE.

Disclaimer:

Information contained herein is believed to be accurate but is not guaranteed. AgraSight and information sources assume no responsibility or liability for any action taken as a result of any information or advice contained in these reports, and any action taken is solely at the liability and responsibility of the user.

ADDITIONAL READS

Farmers Gather Information on New Market for Carbon Storage

Carbon Offsets for Grassland Pilot and Rancher Profit

Investing In Vertical Farming: Five Take-Aways

“Business opportunities are like buses, there’s always another one coming.” – Richard Branson

Thanks for reading our newsletter this week. Don’t hesitate to reach out if you have any questions!

Have a great Sunday everyone,

-Austin